As the era of petrol- and diesel-powered engines draws to a close and the age of the electric vehicle dawns, the British motor manufacturing industry is on the cusp of an exciting new phase in its history

Albeit one also filled with uncertainty, with the long-term repercussions of events such as the UK’s exit from the EU still unclear. To strengthen its position while navigating this period of change, the industry would benefit from boosting efficiency, particularly within its supply chain.

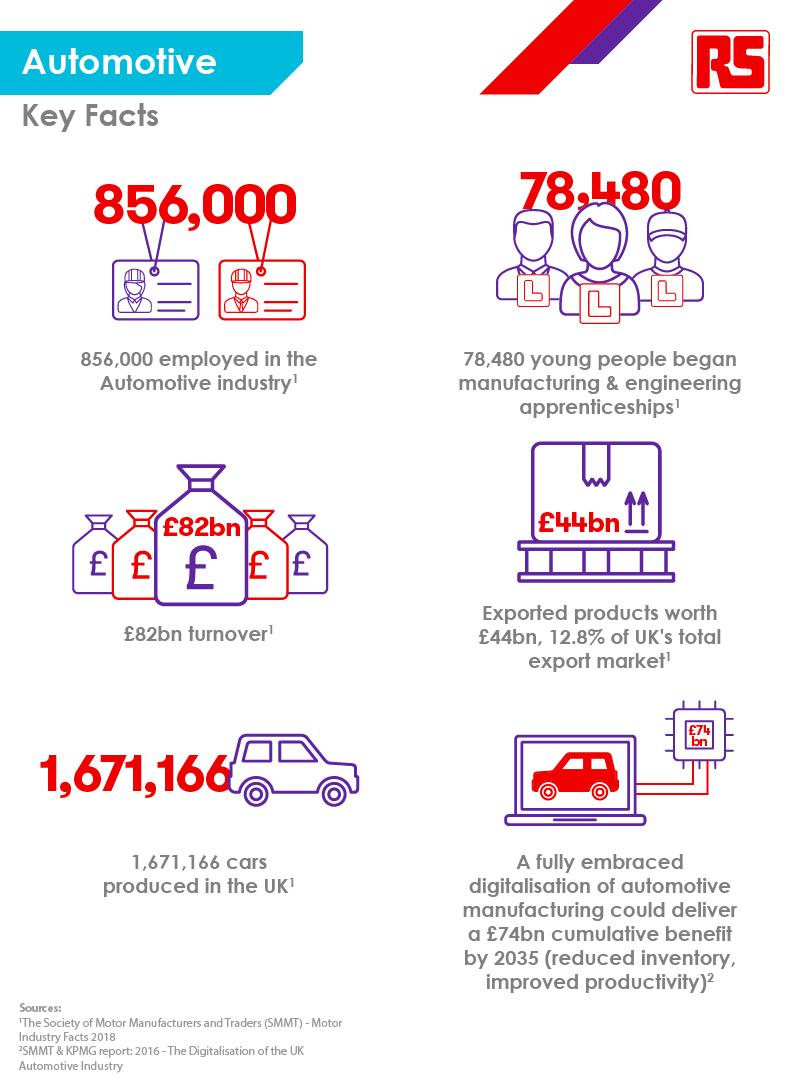

At its peak in the 1970s, the UK auto industry produced something in the region of 1.92 million vehicles per annum. Today the figure is much lower, but the British automotive landscape is very different. Once familiar names like Austin, British Leyland, MG, Rover, Talbot, and Triumph are long gone and may even mean next-to-nothing to a younger generation.

But all is not doom and gloom. Before the coronavirus pandemic disrupted both the manufacturing and sale of cars around the world, the automotive industry in the UK employed over a million people (180,000 directly and further 864,000 in the supply chain). In 2019, the industry produced over 1.3 million cars, 80% of which were destined for export.

In the face of current uncertainty, the sector therefore needs to focus on making improvements in those areas where it has influence. One such being supply chain efficiency. While many may focus on direct procurement to achieve efficiencies, another important area where waste can be tackled and poor practices eradicated is within the indirect procurement category and industrial supplies for Maintenance, Repair & Operations (MRO). Research by RS shows that for every £1 spent on an MRO product, £2 is spent on the MRO ordering process, showing that there are significant efficiencies to be made.

“Organisations don’t always understand what MRO is, and therefore do not see the need or value in having a strategy in place to deal with MRO,” says Helen Alder, Head of Knowledge at the Chartered Institute of Procurement and Supply (CIPS). “There are a number of reasons why you should have an MRO strategy, but probably the most significant is that among the products you purchase will be items that would cause your operations to grind to a halt if they fail and you can’t replace them quickly.”

Dealing with unplanned maintenance

This is clearly a risk that automotive manufacturers and OEMs (Original Equipment Manufacturer's) supplying the industry should take seriously as unplanned maintenance can impact productivity and therefore their bottom line. The answer, says Alder, is to have “a reliable set of approved suppliers that you can trust to have the products you need in stock, at a price you are willing to pay and which they can deliver when and where you need them.”

"An agreed MRO strategy that involves buying from approved suppliers can keep costs in check while guaranteeing availability and quality"Greg Sharp, Industry Sector Manager, RS

One of the issues, as Greg Sharp, Industry Sector Manager, RS, explains, is that there is often too much attention given to price. “Procurement professionals and senior management can be too focused on the prices on a spreadsheet, but what that doesn’t show are the overall process costs,” he explains. “When engineers or other people who make MRO purchases are not following an agreed strategy or using approved suppliers, higher costs and inefficiency creep in.”

These points, and others, are also explored in depth in the 2020 Indirect Procurement Report, jointly produced by RS and CIPS.

Tackling maverick spend

This type of non-approved or maverick spending is one of the biggest problems in MRO procurement, says Alder. “There’s the chance that buying parts from a non-approved supplier will cost more, and possibly take longer to source, but the biggest issue is the quality of the parts,” she warns. “It’s not unknown for engineers or other employees to search the internet and buy parts that turn out to be counterfeit or which don’t meet required quality levels.

"Don’t be too focused on the list price of items as they’re just one part of the overall cost to the business – lost time might be hard to see but it’s impossible to recover"Greg Sharp, Industry Sector Manager, RS

“Just like consumers shopping at home, there are people who will look up items online, see a ‘too good to be true’ price and not consider the possibility that it’s counterfeit,” Alder adds. “The only way to avoid this is to work with trusted, pre-qualified suppliers that can prove the quality of everything they sell. If sub-standard products are put into machines with moving parts, you have potentially serious consequences if they fail.”

Having established the need to consolidate your supplier base to a key group of approved suppliers, the next step is implementing that step and gaining buy-in from engineers. Maverick spending is commonplace, so a concerted effort is needed to break the habit and bring MRO spend under control of the procurement department.

First, says Sharp, the procurement team has to communicate with engineers to understand what products they need and to ensure that the approved suppliers they sign contracts with stock them.

The next step is to make switching to approved suppliers as pain-free as possible. “Through the use of integrated eProcurement systems like the one RS has, it's possible to make the ordering process really easy,” Sharp says. “By streamlining ordering through technology it is much more likely that the user will be willing to change their habits.”

By engaging with engineers and other employees who make regular MRO purchases, it’s possible to shift away from uncontrolled spend with random suppliers and channel the majority of MRO through approved suppliers. The business can then work with suppliers to review spending data, review stock holdings in store rooms and remove significant costs from the entire process.